- Published on

China’s Robot Fever Meets Reality: Beijing Warns of ‘Bubbles’ and ‘Repetitive’ Clones

The map of China's robotics industry is becoming incredibly crowded, and Beijing has decided it is time to thin the herd.

On Thursday, the National Development and Reform Commission (NDRC)—China's top economic planner—issued a direct warning to the country’s burgeoning humanoid robotics sector. Li Chao, a spokesperson for the NDRC, cautioned companies to prevent the risk of "highly repetitive products" entering the market.

With over 150 humanoid robot companies now operating in China, Li noted that "speed and bubbles" are perennial issues in frontier industries that must be "managed and balanced."

The statement marks a pivotal shift in tone. After years of aggressive subsidies and local government incentives that fueled a "Cambrian explosion" of startups, the central government is signaling that the era of unbridled expansion is over. The goal now is not just more robots, but better ones, as the state moves to prioritize genuine innovation over what it terms "low-level redundancy."

Visualizing the "Fever"

The sheer density of this competition was vividly illustrated this week by Tuo Liu, founder of the open-source hardware community Robotuo.

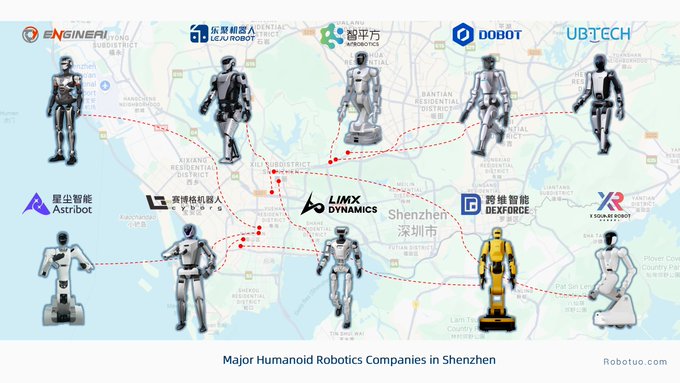

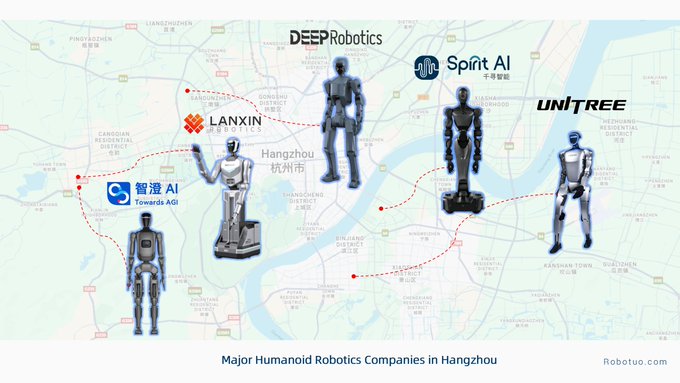

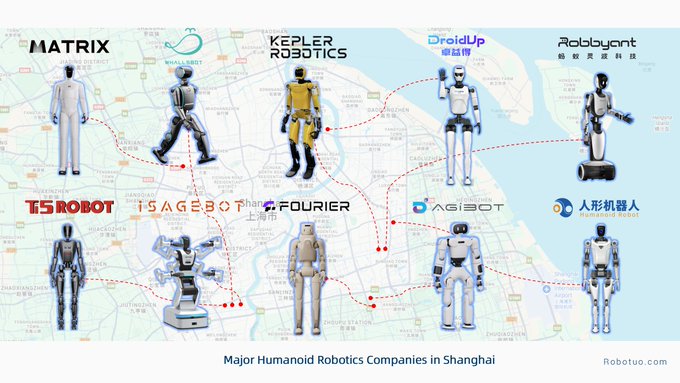

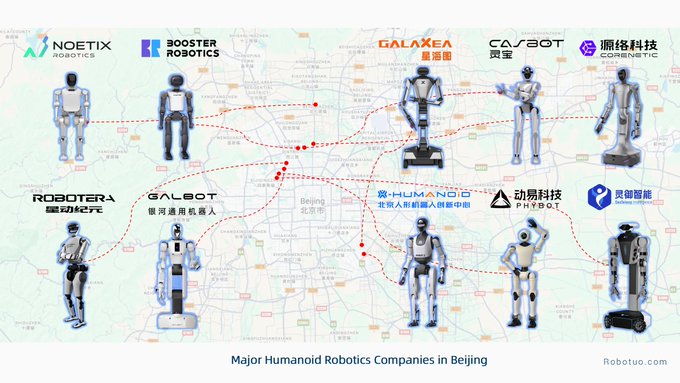

Liu, whose organization leverages Shenzhen’s ecosystem to support global builders, released a series of industry maps detailing the humanoid clusters in China’s four major technology hubs: Beijing, Shanghai, Shenzhen, and Hangzhou.

"It might feel overwhelming to see so many humanoids," Liu tweeted, "but it’s exciting to see these robotics companies working hard to push humanity forward."

The maps reveal a saturated landscape:

- Hangzhou: Home to established heavyweights like Unitree Robotics and the newly IPO-bound Deep Robotics, creating a "quadruped-first" hub that is rapidly pivoting to bipeds.

- Shanghai: A center for "embodied AI" startups, hosting Agibot (Zhiyuan), Fourier Intelligence, and Kepler.

- Shenzhen: The traditional hardware capital, featuring listed giants like UBTECH alongside newer entrants like LimX Dynamics and Astribot.

- Beijing: A dense cluster of research-backed startups including Galbot, Robotera, and Xiaomi’s robotics division.

While Liu views this density as a sign of vigorous effort, the NDRC views it as a capital efficiency problem. The fear is a replay of the "EV playbook"—a massive influx of capital leading to a glut of indistinguishable products that waste resources without advancing the underlying technology.

The "Repetitive Product" Trap

The core of the NDRC's critique is "repetitiveness." In the rush to secure funding and local government grants, many startups have rushed to produce hardware that looks the part but lacks differentiation.

We are seeing a market flooded with "me-too" bipedal chassis that rely on similar supply chains and struggle with the same fundamental flaw: a lack of intelligence. As we noted in our coverage of the Hongqiao Forum, industry leaders like Unitree’s Wang Xingxing have already warned that hardware has outpaced AI, describing the current state of robotic brains as being "one to three years before the launch of ChatGPT."

The government's intervention suggests a desire to shift the focus from the "cerebellum" (balance and walking, which is largely solved) to the "cerebrum" (cognitive processing and meaningful work).

From Chaos to Consolidation

This warning from Beijing aligns with a broader trend of "capital discipline" we’ve been tracking throughout late 2025.

The "IPO Rush" currently underway—with Unitree, Aelos, and AgiBot all vying for public listings—is partly a reaction to this tightening environment. As venture capital becomes more discerning and state guidance stricter, companies are racing to the public markets to secure the "war chests" needed to survive the inevitable consolidation.

Jeff Cardenas, CEO of US-based Apptronik, recently observed this phenomenon from across the Pacific, noting that while it feels like "there's a new Chinese humanoid company every week," the reality of "hard tech" will eventually filter out the pretenders.

Beijing appears intent on accelerating that filter. By setting up a "Dream Team" standards committee led by the founders of Unitree and AgiBot, the Ministry of Industry and Information Technology (MIIT) is already essentially picking its winners.

The message to the companies on Tuo Liu's maps is clear: The phase of wild experimentation is closing. The phase of delivering real industrial value—or disappearing—has begun.

Share this article

Stay Ahead in Humanoid Robotics

Get the latest developments, breakthroughs, and insights in humanoid robotics — delivered straight to your inbox.