- Published on

Chinese Humanoid Maker AgiBot Reportedly Planning Hong Kong IPO Next Year

AgiBot Eyes Public Market Amid Robotics Investment Boom

Shanghai-based humanoid robot developer AgiBot is planning an initial public offering in Hong Kong next year, according to a recent report from Reuters. Sources familiar with the matter suggest the company is targeting a valuation between HK$40 billion and HK$50 billion (approximately $5.14 billion to $6.4 billion).

The move indicates significant momentum for the young company and the broader humanoid robotics sector, which is seeing a surge in investment and competition.

IPO Details and Timeline

AgiBot, also known as Zhiyuan Robotics, has reportedly appointed CICC, CITIC Securities, and Morgan Stanley to manage the listing. While the plans are not yet public, sources suggest the company aims to file a preliminary prospectus early in 2026, with a target for the public listing by the third quarter of that year. The offering is expected to comprise 15% to 25% of the company's shares.

This development follows a period of rapid growth for AgiBot. As we've covered previously in "From Huawei 'Genius' to Robotics Entrepreneur: The Rise of Peng Zhihui and AgiBot", the company was founded in early 2023 by former Huawei engineer Peng Zhihui. In less than three years, it has secured backing from major investors like Tencent, HongShan Capital, BYD, and Hillhouse Investment, reaching a valuation of over $2 billion as of March 2025.

A Competitive Landscape

AgiBot's potential IPO comes as China's government actively promotes the development of automation and robotics to address demographic shifts and enhance its technological capabilities. The humanoid robot space has become particularly active, with numerous startups and established tech firms entering the race.

If successful, AgiBot would join a small but growing list of publicly traded humanoid companies. Ubtech Robotics, which listed in Hong Kong in late 2023, has seen its stock perform strongly. Meanwhile, rival Unitree Robotics is reportedly planning its own IPO on Shanghai’s STAR market.

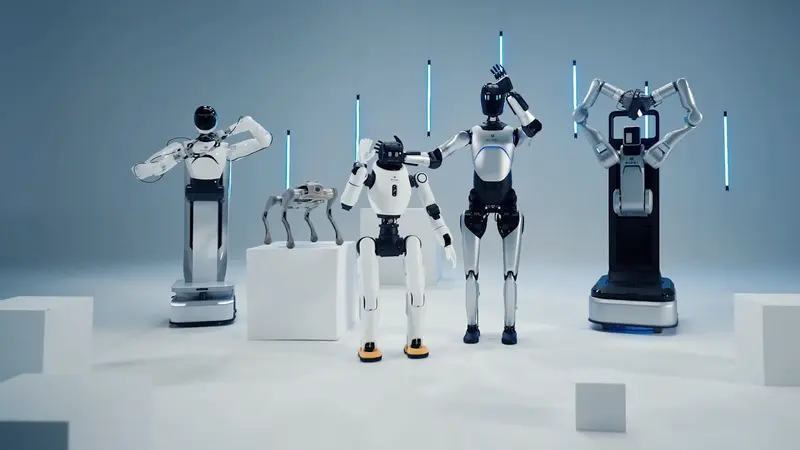

AgiBot is developing several robot lines, including the full-sized "Yuanzheng" humanoid and the smaller "Lingxi" models, targeting applications from manufacturing and logistics to research. The company has focused heavily on building its own AI models and data collection infrastructure to accelerate robot learning.

From Hype to Public Valuation

While the IPO plans signal strong investor confidence, AgiBot and its competitors still face the challenge of proving the commercial viability of general-purpose humanoid robots. High production costs and the need to identify scalable, real-world applications remain significant hurdles for the industry.

A public listing would provide AgiBot with substantial capital to scale production and R&D, but it would also bring the intense scrutiny of the public markets. The company's performance on the Hong Kong Stock Exchange will be a closely watched indicator of the humanoid industry's transition from private investment and hype cycles to sustainable public valuation.

Read more:

Share this article

Stay Ahead in Humanoid Robotics

Get the latest developments, breakthroughs, and insights in humanoid robotics — delivered straight to your inbox.