- Published on

Masayoshi Son's SoftBank Renews Humanoid Robotics Hunt, Targeting AI-Driven Startups

SoftBank Group, led by investor Masayoshi Son, is reportedly intensifying its pursuit of investments in humanoid robot startups, signaling a significant revival of the conglomerate's long-standing ambitions in the robotics sector.

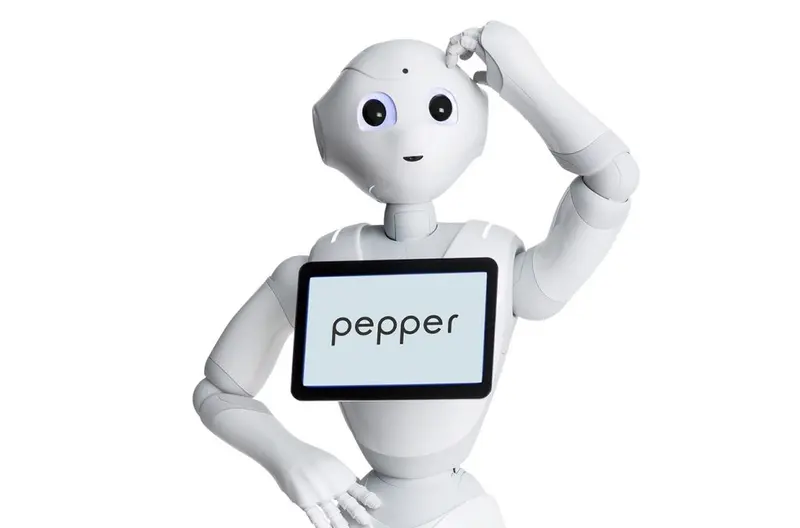

This new push, first detailed in a report by The Information, marks a strategic pivot from the company's previous, high-profile efforts. After mixed results with ventures like the Pepper companion robot, which failed to achieve widespread adoption, SoftBank's focus now appears to be on integrating advanced artificial intelligence with versatile hardware designed for industrial and logistical work.

A Strategy of Targeted Bets

Instead of a single flagship project, SoftBank is reportedly scouting and engaging with several promising startups that could define the next wave of automation.

This strategy is evidenced by several recent moves. SoftBank was a participant in Agility Robotics' reported $400 million funding round earlier this year, which is aimed at scaling production of its Digit robot for warehouse tasks. This follows earlier reports of talks between the two companies for a potential $900 million acquisition.

The investment focus extends beyond just bipedal hardware. SoftBank has also reportedly been in negotiations for a potential $500 million investment in Skild AI, a startup developing foundational AI models for robotics, at a $4 billion valuation. This move suggests a two-pronged strategy: investing in both the "bodies" (the robots) and the "brains" (the AI platforms) that will power them.

Other potential targets have been evaluated. Reports from 2023 indicated that SoftBank considered leading a $75 million to $100 million round for 1X Technologies, another key player in the humanoid space, illustrating the company's active hunt for a dominant market position. 1X is reported to seek up to $1B at a valuation of $10B or more.

Learning from Pepper's Legacy

This renewed push is informed by lessons from past setbacks. The Pepper robot, marketed as an emotional companion, highlighted the immense challenge of commercializing social robotics.

The new targets, by contrast, are focused on versatility, intelligence, and performing human-like tasks in complex industrial environments like manufacturing and elder care. Masayoshi Son has long prophesied a future where robots are ubiquitous, and this new strategy appears to be a more pragmatic, industry-focused attempt to realize that vision.

This focus on industrial automation is further underscored by SoftBank's high-profile, $5.4 billion acquisition of ABB Ltd.’s robotics division. That deal provides SoftBank with established expertise in industrial automation, which it can now seek to infuse with cutting-edge AI innovations from its new portfolio of startup investments.

Navigating a Crowded and Costly Field

SoftBank is re-entering a field that has become intensely competitive and capital-intensive. The high valuations demonstrate the escalating costs of entry, and the company faces a landscape crowded with powerful players, including Boston Dynamics, UBTECH Robotics, Tesla's Optimus project, and other heavily funded startups like Figure.

Son's broader vision reportedly includes a massive $100 billion investment in U.S. AI infrastructure. By placing strategic bets across the robotics ecosystem—from industrial arms (ABB) to mobile hardware (Agility) and foundational AI (Skild AI)—SoftBank is clearly attempting to build a dominant position.

The challenge, as with all humanoid ventures, will be to convert these massive investments into commercially viable, reliable products that can be deployed safely and effectively at scale.

Share this article

Stay Ahead in Humanoid Robotics

Get the latest developments, breakthroughs, and insights in humanoid robotics — delivered straight to your inbox.