- Published on

The Great Valuation Chasm: A 2025 Guide to the Humanoid Robotics Capital Race

The humanoid robotics sector has entered a new, brutally expensive phase. The era of impressive lab demos is over, replaced by an intense, global capital race to fund the immense challenge of mass manufacturing and artificial intelligence development.

As of late 2025, a clear "great valuation chasm" has emerged. A top tier of roughly a dozen companies now commands valuations in the billions or tens of billions, while a second tier of specialized firms trails far behind.

This race is also defined by two starkly different strategies:

- The Western "Mega-Valuation" Strategy: US and European leaders like Figure, 1X Technologies, and Neura Robotics are raising massive, private "war chests" from strategic tech consortiums, achieving "decacorn" ($10B+) valuations before generating significant revenue.

- The Chinese "IPO Rush" Strategy: A cohort of leading Chinese firms—notably Unitree, AgiBot, and Aelos Robotics (Leju)—is simultaneously rushing to the public markets in Hong Kong and Shanghai to fund their scaling efforts.

Based on public market data and our analysis of private funding reports, here is a definitive ranking of the industry's most valuable players.

Part I: The Pure-Play Valuation Leaders

This list ranks the "pure-play" companies—firms whose primary business is robotics—by their latest confirmed or targeted valuation.

Tier 1: The "Decacorn" Champions ($10B+ Valuation)

1. Figure (USA) - $39 Billion (Confirmed)

Figure has established itself as the undisputed private leader. In September 2025, the company confirmed its Series C round secured over $1 billion, locking in a post-money valuation of $39 billion. This staggering valuation is built on an unparalleled coalition of strategic investors, including Microsoft, OpenAI, Nvidia, Intel, Jeff Bezos, and Salesforce, effectively positioning it as the "national champion" for the US tech industry. The capital is aimed at scaling production of its Figure 03 robot and developing their in-house AI system Helix.

2. Neura Robotics (Germany) - $11.6 Billion (Targeted)

Europe's primary contender, Neura, is in talks for a landmark funding round. As of mid-November 2025, Tether, the issuer of the world's largest stablecoin, is reportedly in talks to lead a €1 billion ($1.16B) investment that would value Neura between $9.29 billion and $11.6 billion. This signals a new phase where deep-pocketed investors from outside traditional tech VCs are funding the race. Neura and Schaeffler recently announced a partnership around Neuras 4NE-1 humanoid.

3. 1X Technologies (Norway/USA) - $10+ Billion (Targeted)

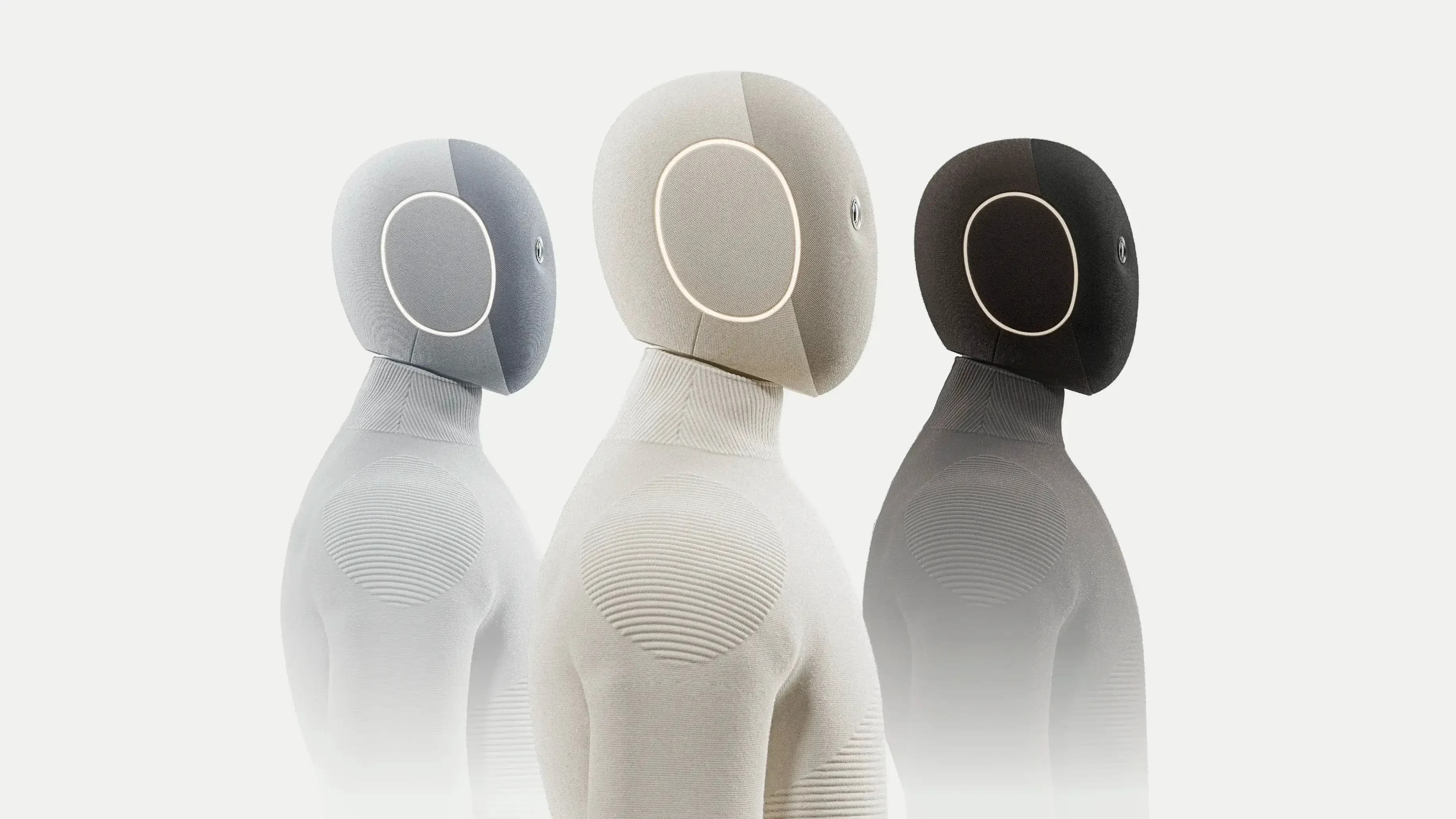

In September 2025, reports emerged that 1X, backed by the OpenAI Startup Fund, was seeking to raise up to $1 billion at a valuation of $10 billion or more. This represents a more than 12-fold leap from its January 2024 valuation. 1X has distinguished itself by targeting the consumer market with its bipedal NEO android. The prodcut launch sparked controversy over privacy concerns and 1X "selling the dream".

Tier 2: The Public & Pre-IPO Rush ($5B - $8B Valuation)

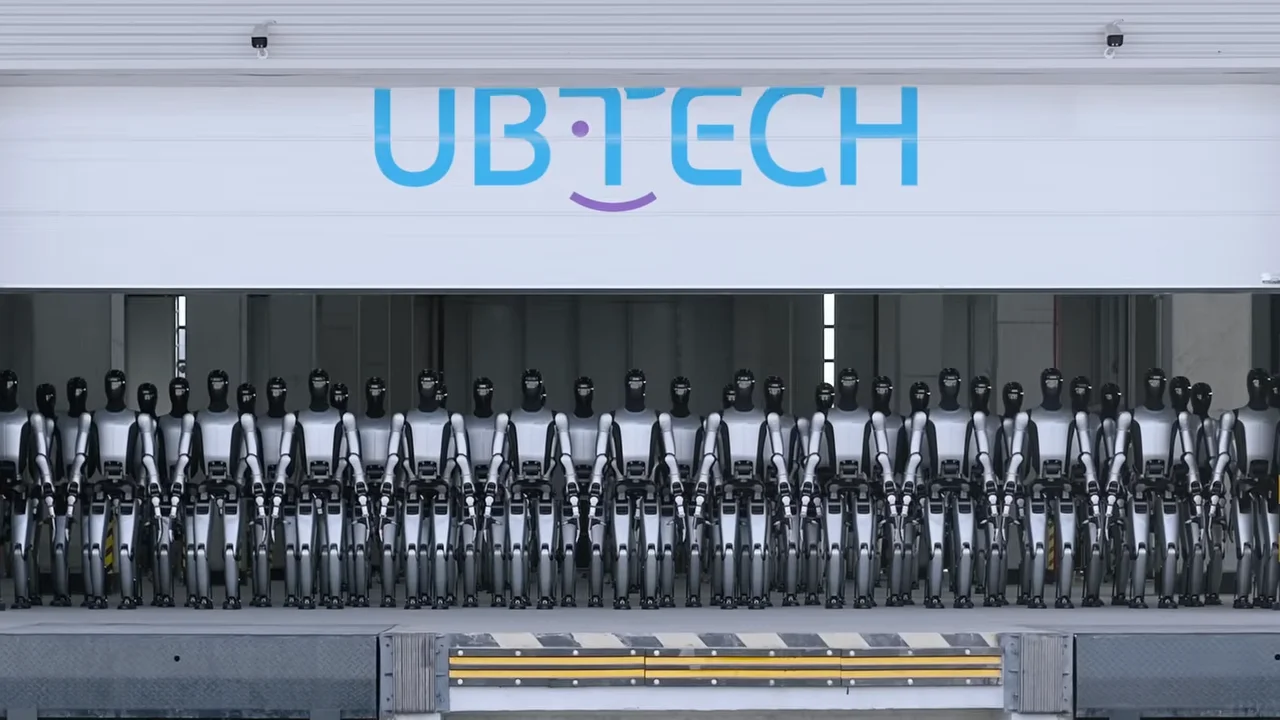

4. UBTECH Robotics (China) - $7.93 Billion (Public)

As one of the first humanoid companies to go public, UBTECH serves as a critical real-world benchmark. Listing on the Hong Kong Stock Exchange in late 2023 , its market cap hit $7.93 billion (58.61B HKD) as of November 2025. Its strong stock performance has fueled the "IPO rush" for its domestic competitors.

UBTECH recently announced the first mass delivery of their Walker S2 humanoid. An announcement that sparked controversy.

5. Unitree Robotics (China) - $7.0 Billion (Targeted IPO)

At the forefront of the Chinese IPO wave, Unitree is reportedly targeting a valuation of up to $7 billion (50B yuan) for its planned listing on Shanghai’s STAR market. A "hardware-first" company, Unitree is a rare case in the sector, claiming it has been profitable since 2020, thanks to its legacy quadruped robot business. Their new R1 model was named on the list of 2025's best inventions by TIME magazine. They recently unveiled their latest model, the H2.

6. AgiBot (Zhiyuan Robotics) (China) - $6.4 Billion (Targeted IPO)

The "AI-first" counterpoint to Unitree, AgiBot was founded in early 2023 by a former Huawei "genius" engineer. The company is planning an initial public offering in Hong Kong for 2026, targeting a valuation of up to $6.4 billion (HK$50B). It is backed by a powerful coalition including Tencent, HongShan, BYD, and LG Electronics.

7. Rainbow Robotics (South Korea) - $5.81 Billion (Public)

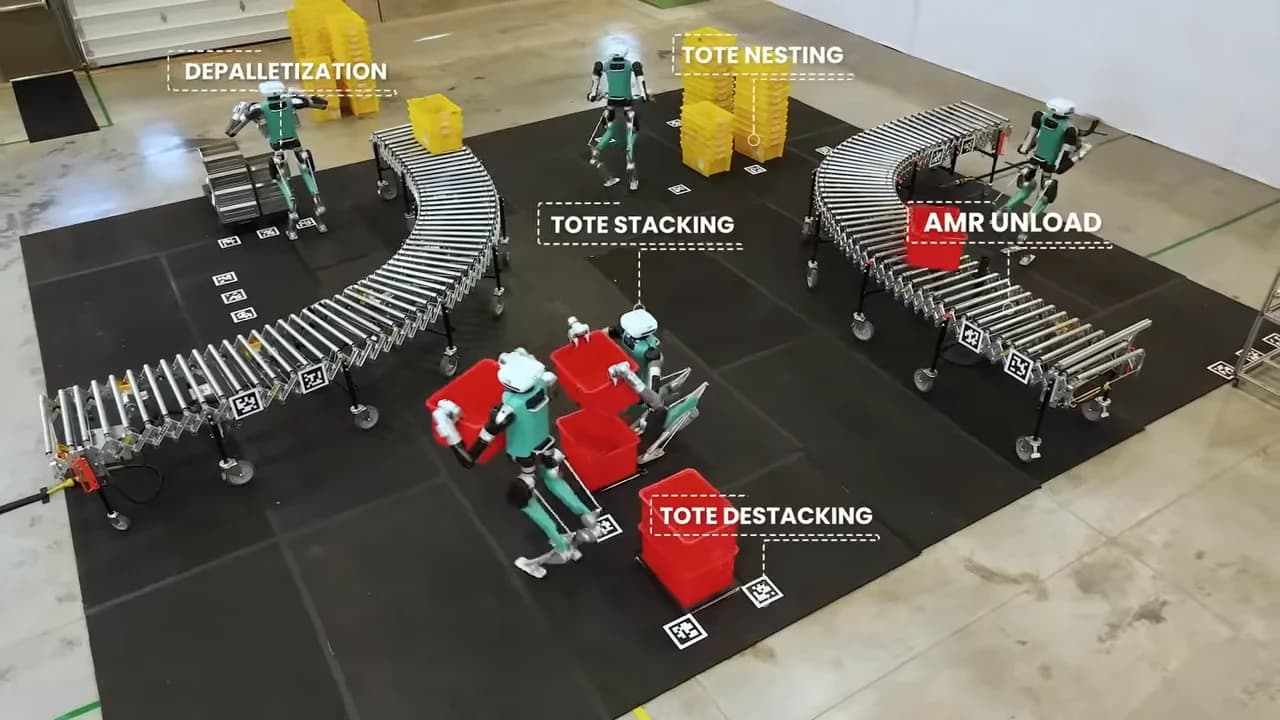

The second key publicly traded benchmark, Rainbow Robotics (KOSDAQ: 277810), has seen its valuation skyrocket, largely due to its primary strategic partner: Samsung Electronics. Samsung is a major investor, making Rainbow's $5.81 billion market cap a reflection of both its own technology and the market's confidence in its role as a key partner to a global tech giant. Rainbow Robotics recently partnered with CJ Logistics to develop AI powered humanoids for warehouse tasks.

8. Apptronik (USA) - $5.47 Billion (Confirmed)

Austin-based Apptronik has had a blockbuster 2025, raising over $1 billion in 2025 alone. This "war chest" was built on a $403M Series A in the spring and a subsequent, larger round in October, resulting in a confirmed $5.47 billion post-money valuation. Apptronik's ecosystem includes partners like Google, Mercedes-Benz, and a manufacturing deal with Jabil to build its Apollo robot at scale.

Tier 3: The Billion-Dollar Contenders

9. Agility Robotics (USA) - $2.12 Billion (Confirmed)

A pioneer in legged robotics, Agility’s valuation is more conservative, reflecting its pragmatic, focused strategy. Valued at $2.12 billion after a $400 million round in March 2025 , Agility is targeting its "Digit" robot on a single, provable use case: warehouse logistics. This industrial-first focus is validated by its key investors, Amazon and SoftBank.

10. Fourier Intelligence (China/Singapore) - $1.1 Billion (Confirmed)

Successfully transitioning from rehabilitation robotics, Fourier's pre-money valuation was cited at $1.1 billion (8B yuan) in May 2025. Backed by the SoftBank Vision Fund, its GR-1 humanoid places it as a significant, billion-dollar contender.

Part II: The Titans and the "Proxy War"

A direct comparison between a startup like Figure and a $1.4 trillion conglomerate like Tesla is analytically flawed.

A more useful framework is to see these diversified "Titans" as "kingmakers" in a strategic proxy war. Their total market capitalization represents their "war chest"—an ability to fund R&D, acquire any competitor, or, most importantly, back a chosen champion.

1. Tesla (USA) - The $1.4 Trillion Antagonist

Tesla is the great exception. Its "Optimus" project is not a side bet; it's a core pillar of a potential future $25 trillion valuation, in CEO Elon Musk's view. Tesla's strategy is pure vertical integration: using its own AI, battery, and manufacturing expertise to build the entire stack in-house. It is the benchmark against which all other consortiums are competing.

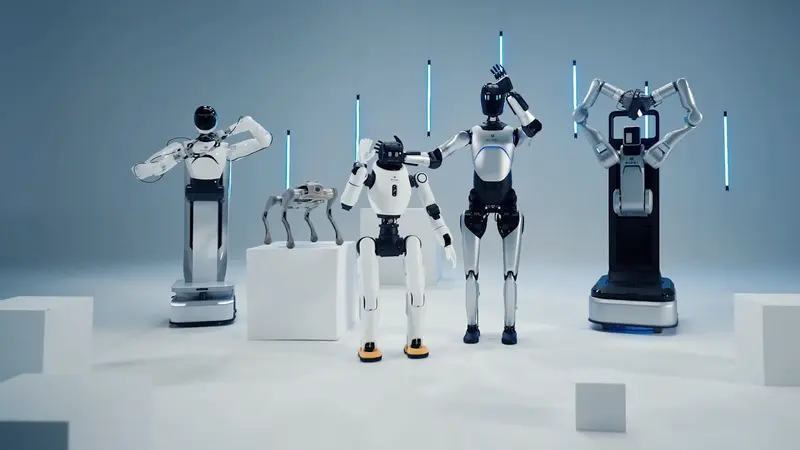

2. Samsung (South Korea) - The $435 Billion Hybrid

Samsung is playing a powerful hybrid strategy. In November 2025, it confirmed its own in-house humanoid development, aiming to use robots in its own factories. Simultaneously, it is the key strategic investor in Rainbow Robotics ($5.81B public valuation).

3. The "Kingmaker" Consortiums The rest of the field is largely a battle between strategic teams:

- Team US/Open (Backing Figure AI & Apptronik): This is a powerful, unified front of American tech, with Nvidia, Microsoft, OpenAI, Intel, Amazon, and Google all placing strategic bets on Figure and/or Apptronik.

- Team China (Backing AgiBot & Unitree): A similar domestic coalition has formed in China, with tech giants Tencent, Alibaba, BYD, and Huawei-affiliated funds backing AgiBot, Unitree, and Aelos.

- Team SoftBank (Backing Agility & Fourier): The Japanese giant is acting as a global "kingmaker," holding significant stakes in both the US-based Agility Robotics and the China-based Fourier Intelligence.

Final Analysis: A Race Defined by Capital

The 2025 humanoid robotics landscape is not a race for the best demo; it's a "war chest" race. With the notable exception of Unitree's claim to profitability, the top pure-play companies are pre-revenue.

Valuations are not based on current earnings but on investor confidence in a company's ability to fund the multi-billion-dollar journey to mass production. The $1 billion+ raises by Figure and Apptronik are now seen as the minimum buy-in to compete, creating a "great valuation chasm" that has locked out all but a handful of the most well-backed players.

Share this article

Stay Ahead in Humanoid Robotics

Get the latest developments, breakthroughs, and insights in humanoid robotics — delivered straight to your inbox.